Financial Planning

March Madness – Stock Market Edition

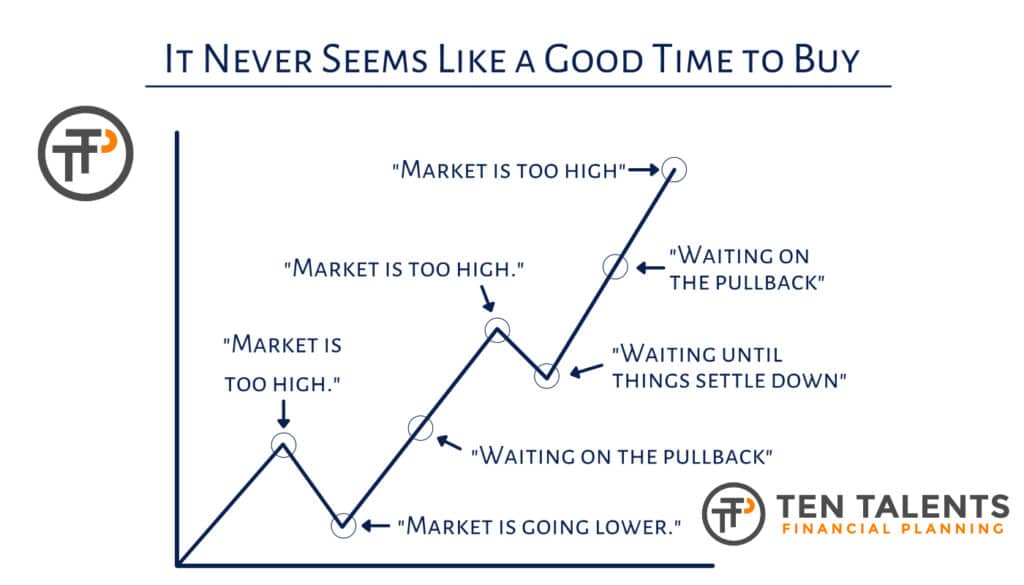

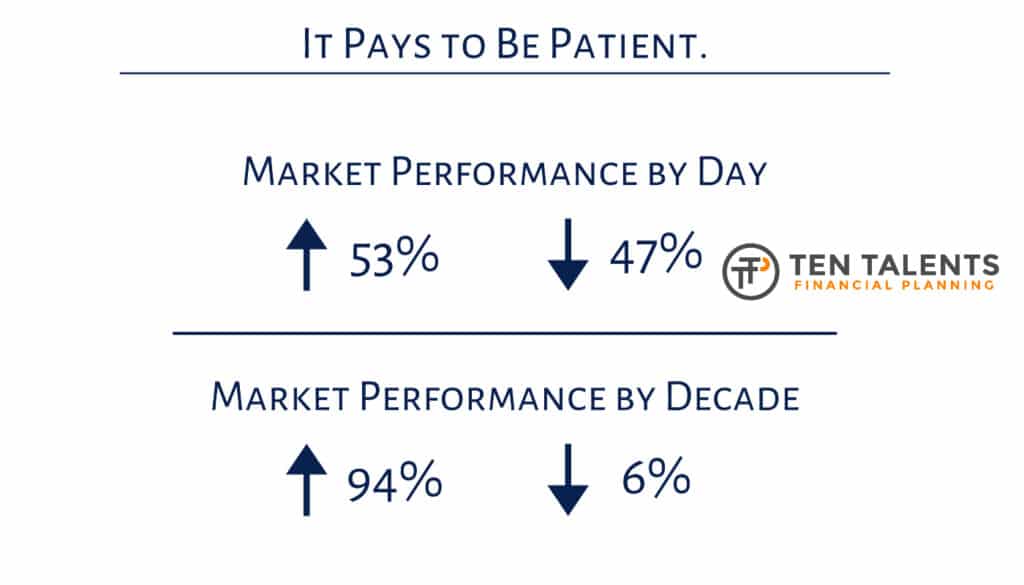

March Madness – Stock Market Edition As we prepare for basketball’s march madness tournament, it is a good time to reflect on how maddening the stock market can be. What causes the madness of the markets? Many things, but one of the greatest frustrations to investors is the significant fluctuations in asset prices, or volatility.…

Read MoreThe Illusion of Investment Skill

The Illusion of Investment Skill Have you ever made an investment decision and used the immediate outcome to determine your own investment skill or lack of skill? Did you know that this is the WORST way to determine whether and investment decisions was good or bad? How Do We Judge Decisions? Well then, how do…

Read MoreAre We Due for a Change?

Are We Due for a Change? In January the stock market, despite years of high interest rates and recession concerns, hit a new all-time high. This was largely driven by strong corporate earnings, a robust job market, and improving consumer sentiment. Whenever the market is on a long winning streak or even hits new highs,…

Read MoreDoes Your Rope Have Slack In The Line?

Does Your Rope Have Slack In The Line? Enjoy this analogy of The Rope of Life! The Rope of Life Does your rope have slack in the line? Or is your rope of life tight with no margin? Financial Planning and Having Margin Learn how this analogy ties into financial planning and tackling financial goals…

Read MoreSucceeding at Self-Control

Succeeding at Self-Control Self-control is an important characteristic to develop that can help us in all aspects of our lives from biting our tongue, to passing on the sweet treat, to accomplishing our New Year’s resolutions. But it isn’t easy! In fact, it can be downright painful, especially when trying to control some urge. It’s…

Read MoreHow Your 401(k) Is Like An Oven

How Your 401(k) Is Like An Oven Are you frustrated with your 401(k) account? Is Your 401(k) a Scam? Do you think that your 401(k) is a scam or just doesn’t work? Realize that perhaps it’s not the 401(k) account’s fault! It’s Like Baking A Cake Your 401(k) account is akin to an oven when…

Read MoreThe Illusion of Foresight

The Illusion of Foresight Have you ever thought that if you had a crystal ball you could be a better investor? (This is called the illusion of foresight.) Would a Crystal Ball Matter? Do you think that if you knew the future, you could invest with better results? Is this actually true in real life?…

Read MoreWho Would Have Thought

Who Would Have Thought One of the best things about a year coming to an end is to look back and identify key lessons that we can use to improve our decision-making going forward. This is especially true in the investment realm. 2023 – Lots of Bad News Late in 2022, market and economic experts…

Read MoreClient Success Story

Client Success Story Fair warning: Soapbox Moment! I got really excited to see this success story with a Client on the specific topic of insurance. Specifically, auto/home/umbrella insurance coverages and massively increasing coverage while decreasing their premiums. Key Takeaway What are the key takeaways from this story? Namely, belief precedes receiving value! This is not…

Read MoreAchieving Success

Achieving Success As the year comes to an end, it’s a good time to reflect upon the year behind us. The good things, the bad things, and the success we achieved along the way. Sometimes we rely upon favorable circumstances to achieve success, but circumstances are often beyond our control. While our circumstances can make…

Read More