Investment management

Stock Market Returns Are NOT What You Think

Stock Market Returns Are NOT What You Think What would you guess is the S&P 500 average annualized return from January 1, 2000 to January 1, 2020? Would you think 9%? Maybe 10%? Heard 12% on the radio? Maybe you heard 12% on the radio? Reality is much more sobering: 6.2% average annualized return for…

Read MoreThe Magnificence of Diversification

The Magnificence of Diversification Diversification is often defined as “Don’t put all your eggs in one basket.” It’s something we do to reduce volatility and manage risk. But there is another reason to diversify. We diversify in an attempt to increase the return on our investments. Diversification provides opportunity for investors to both reduce risk…

Read MoreBank Failures Are More Common Than You Think

Bank Failures Are More Common Than You Think Check out this link to learn more about the almost 600 bank failures in the past 23 years! Bank failures are more common than you think and you can use this link below to review on your own. Check Out This FDIC Link You can learn more…

Read MoreHow to Make Money In Stocks

How to Make Money In Stocks This is how you make money in stocks! Hint: It actually starts with cash. 🙂 Cash is the Key Learn how holding cash enables you to make higher stock market returns over time. Thank You Thank you for watching and I hope you have a blessed day! – Kaleb…

Read MoreRemember This During Market Declines

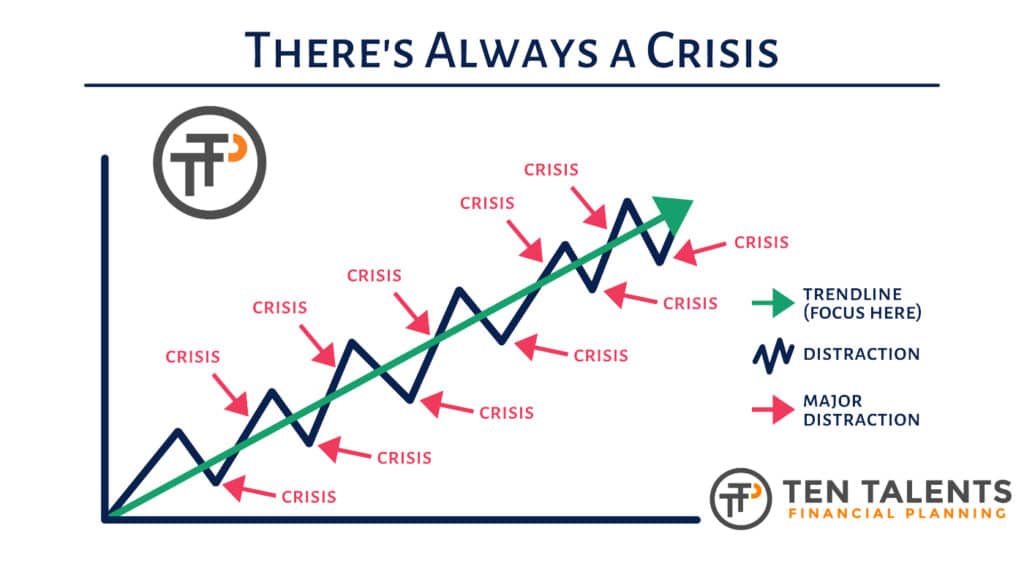

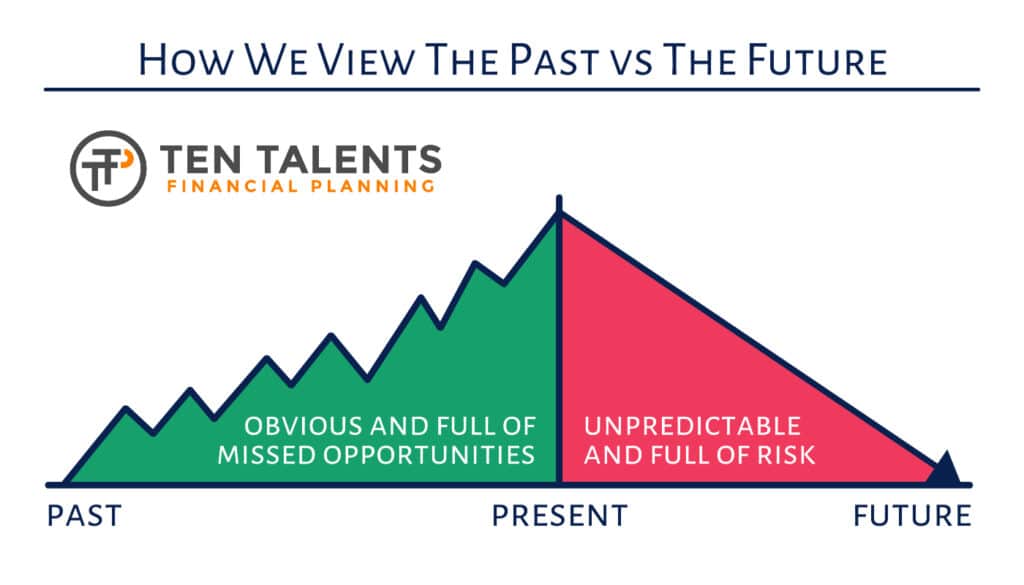

Remember This During Market Declines Are you thinking it’s time to take excess risk since your investments are declining or sideways? We’d say, “Remember This During Market Declines” to help frame correct perspective. Impatient or antsy? Are you getting impatient and antsy with your investments? Focusing on truth Instead, realize the TRUTH of what really…

Read MoreWhat if You Got a Glimpse of the Market’s Future?

What if You Got a Glimpse of the Market’s Future? Let’s say your friend came back from the future and shared a glimpse of stock market performance. He said that 3 months from now the stock market will be lower. He didn’t elaborate but hearing that the market would be lower got you concerned. You…

Read MoreInvestment Counsel from Warren Buffett

Investment Counsel from Warren Buffett Investing may be simple in principle, but it isn’t easy in practice. Markets and economies are fraught with uncertainty, constantly changing news and markets, and how great some other investment is performing. Warren Buffett is one of the most successful investors of all time. From time to time he shares…

Read MoreInvesting When News Is Horrible

Investing When News Is Horrible Have you turned on the news lately? Do you feel like bad news is getting so bad you CANNOT possibly invest when bad things are happening in the world? How Can You Invest Well? In this video, we ask if there has ever been a time in the history of…

Read MoreThe Eventual Recession

The Eventual Recession Since early last year economists, market experts, and even corporate CEOs were predicting a recession for this year. Most of them said it would happen early in the year.1 A recession was the consensus view among experts, almost a foregone conclusion. With inflation surging to 9% last summer and the Fed aggressively…

Read MoreActing Like an Investor

Acting Like an Investor Many investors today unknowingly act like speculators. How do I know this? Because they are more concerned and influenced by short-term stochastic changes in stock prices than in the underlying fundamentals of a company. And when coupled with a barrage of negative news stories, it can be very difficult to act…

Read More