Investment management

The Paradox of Investing

The Paradox of Investing How do you “feel” about your investment portfolio? Did you know that your feelings can often be an inverse indicator when it comes to investing? The Meaning of Feelings and Investing What does it mean when you feel the worst? What does it mean when you feel the best? Learn about…

Read MoreWhat Game Are You Playing?

What Game Are You Playing? How do you think you would do playing tennis and using a golf club, instead of a racket? Or driving down the basketball court wearing hockey skates? Using the wrong equipment for the game we are playing will negatively affect our performance. The same thing can be said for investing.…

Read MoreWhy Don’t We Pile Into Alternative Investments?

Why Don’t We Pile Into Alternative Investments? Have you seen advertisements for “alternative” investments during this current year market decline? Should you be selling existing investments and piling into “safe alternatives” when you see your account balances at lower values? How “Safe” Are These Alternative Investments Really? Enjoy this video on how to view and…

Read MoreBoring is Beautiful

Boring is Beautiful Over the past few years, many investments have been hyped by the financial media and several have experienced near-parabolic gains. These include meme stocks, cryptocurrencies, major technology firms, and companies that thrived from changes during the pandemic. Hype and watching asset prices skyrocket produce a “get rich quick” mentality. This mentality activates…

Read MoreTis the Season of Forecasts

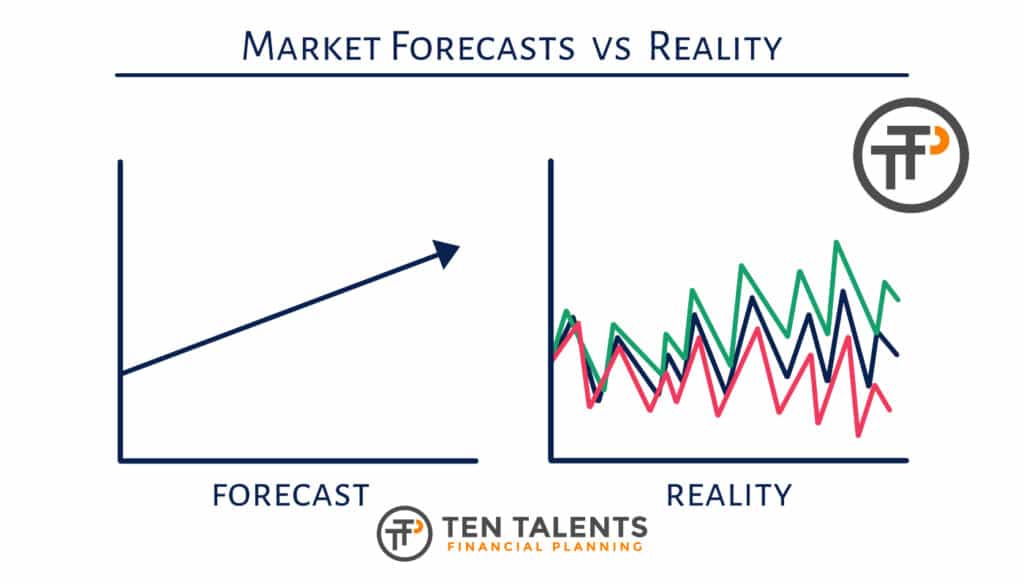

Tis the Season of Forecasts It’s that time of year. No, not the holidays. It’s the time that every analyst, economist, and strategist will declare their forecasts for 2023. These forecasts come from well-educated, intelligent individuals – with many years of experience. Some of the forecasts will be made with much confidence. No matter. You…

Read MoreEverything is Transitory

Everything is Transitory Last year we were told that inflation was transitory. This year we learn that it is more persistent. And now investors have entered a bear market. Investors may be wondering how transitory or persistent this bear market may be. I wish we knew, but those kinds of things are only known after…

Read MoreWhat’s the Value of a Financial Thinking Partner?

What’s the Value of a Financial Thinking Partner? We all process “Value” differently. Each person thinks differently. Are you more interested in “Tangible” dollar value of financial advice? Tangible or Intangible? Or are you more interested in the “Intangible” value of financial advice? Regardless of your approach, this is a fun topic I love discussing.…

Read MoreChasing Returns

Chasing Returns A favorite (and costly) pastime of investors is to invest in assets that have recently done well. This happens in good times as investors seek better returns, and they happen in bad times as low-yielding investments such as cash are more attractive than money-losing stocks. In other words, investors chase returns. It Feels…

Read MoreWhy does the stock market go up? (Book Review)

Why does the stock market go up? In this video I’m providing a brief review of Brian Feroldi’s, “Why Does the Stock Market Go Up?”. Check it out! Brian explains terms like “Dow Jones”, “What is the S&P 500?”, and of course, answers the question, “Why does the stock market go up?!” Thank You Thank…

Read MoreThe Upside of Bear Markets

The Upside of Bear Markets Bear markets, like large grizzly bears, are often associated with fear and running for safety. These feelings are often exacerbated by fateful headlines with dramatic wording. But for long-term investors, bear markets don’t have to be scary. They can have several benefits. Benefits of Bear Markets First, they produce negative…

Read More