Retirement Planning

You Don’t Invest To Get Rich

You Don’t Invest To Get Rich “You don’t invest to get rich. You invest to preserve and grow wealth.” – Aswath Damodaran How do you define wealth? How do you define being wealthy? If you don’t invest to “get rich”, then how are you supposed to become wealthy in the first place? Defining Wealth Enjoy…

Read MoreThe Illusion of Investment Skill

The Illusion of Investment Skill Have you ever made an investment decision and used the immediate outcome to determine your own investment skill or lack of skill? Did you know that this is the WORST way to determine whether and investment decisions was good or bad? How Do We Judge Decisions? Well then, how do…

Read MoreAre We Due for a Change?

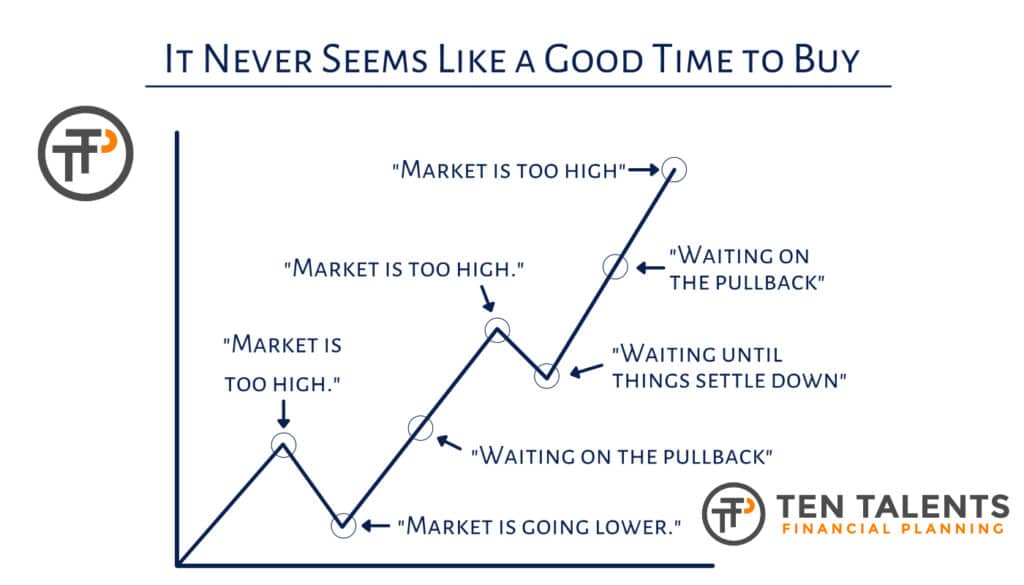

Are We Due for a Change? In January the stock market, despite years of high interest rates and recession concerns, hit a new all-time high. This was largely driven by strong corporate earnings, a robust job market, and improving consumer sentiment. Whenever the market is on a long winning streak or even hits new highs,…

Read MoreSucceeding at Self-Control

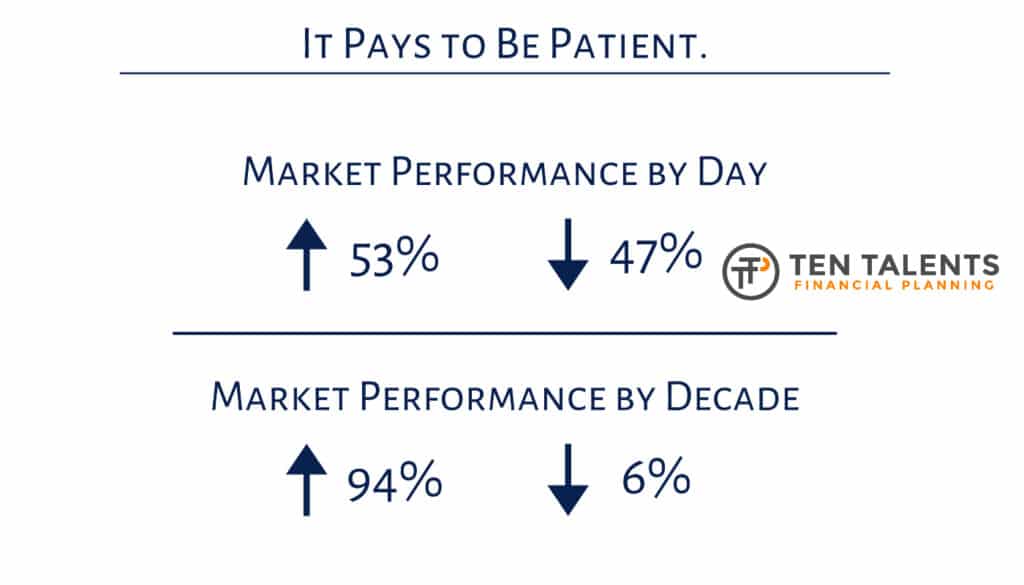

Succeeding at Self-Control Self-control is an important characteristic to develop that can help us in all aspects of our lives from biting our tongue, to passing on the sweet treat, to accomplishing our New Year’s resolutions. But it isn’t easy! In fact, it can be downright painful, especially when trying to control some urge. It’s…

Read MoreHow Your 401(k) Is Like An Oven

How Your 401(k) Is Like An Oven Are you frustrated with your 401(k) account? Is Your 401(k) a Scam? Do you think that your 401(k) is a scam or just doesn’t work? Realize that perhaps it’s not the 401(k) account’s fault! It’s Like Baking A Cake Your 401(k) account is akin to an oven when…

Read MoreAchieving Success

Achieving Success As the year comes to an end, it’s a good time to reflect upon the year behind us. The good things, the bad things, and the success we achieved along the way. Sometimes we rely upon favorable circumstances to achieve success, but circumstances are often beyond our control. While our circumstances can make…

Read MoreWhat Is A Third Party Financial Custodian?

What Is A Third Party Financial Custodian? Have you ever heard of financial scams or folks like Bernie Madoff who bankrupt their Clients? How can you completely avoid this kind of disaster? Transparency Matters Learn about “What Is A Third Party Financial Custodian?” who will “custody” your assets in a transparent manner. You don’t want…

Read MoreForecast Frenzy

Forecast Frenzy ‘Tis the season when financial institutions provide their forecasts for the coming year. Several firms have already published their forecast. RBC and several other firms believe the S&P 500 will make new records in 2024. Whereas Wells Fargo and others have differing opinions. Wells Fargo’s forecast for 2024 said, “It’s really hard to…

Read MoreTimely Economic Perspectives

Timely Economic Perspectives Recently the Wall Street Journal ran with a headline about “Quadruple Threats”1 to the economy. Not to be outdone, on the same day, Marketwatch.com posted an image highlighting five current threats to the economy. These threats are made to be, and can be, concerning. I break down the threats below to help…

Read MoreAdvisor Says You Cannot Retire?

Advisor says you cannot retire? Do you currently work with a financial advisor? What do you do when your financial advisor says you cannot retire? Just keep working? Have they told you to NOT RETIRE but just keep on working? Learn the key questions your Financial Advisor should be asking you before they provide a…

Read More