Retirement Planning

How to Avoid A Retirement Crisis

How to Avoid A Retirement Crisis Are your concerned about how to avoid a retirement crisis for yourself? How can you avoid a retirement crisis and make sure you have options? Financial Planning = Options The iterative process of financial planning is designed to provide optionality and think through various ideas to build your confidence…

Read MoreActing Like an Investor

Acting Like an Investor Many investors today unknowingly act like speculators. How do I know this? Because they are more concerned and influenced by short-term stochastic changes in stock prices than in the underlying fundamentals of a company. And when coupled with a barrage of negative news stories, it can be very difficult to act…

Read MoreOh snap! Your ‘advisor’ doesn’t do retirement planning after all.

Oh snap! Your ‘advisor’ doesn’t do retirement planning after all. It’s an unsettling feeling to learn your Financial “Advisor” doesn’t do retirement planning. What does that mean? Have you ever wondered about the following topics? -When to claim Social Security benefits? -How does healthcare work before Medicare at age 65? How does it work after…

Read MoreWhat Game Are You Playing?

What Game Are You Playing? How do you think you would do playing tennis and using a golf club, instead of a racket? Or driving down the basketball court wearing hockey skates? Using the wrong equipment for the game we are playing will negatively affect our performance. The same thing can be said for investing.…

Read MoreWhy Don’t We Pile Into Alternative Investments?

Why Don’t We Pile Into Alternative Investments? Have you seen advertisements for “alternative” investments during this current year market decline? Should you be selling existing investments and piling into “safe alternatives” when you see your account balances at lower values? How “Safe” Are These Alternative Investments Really? Enjoy this video on how to view and…

Read MoreHave You Considered this HUGE Expense in Retirement?

Have You Considered this HUGE Expense in Retirement? Have you ever considered your largest expenses during your retirement years? Think Differently In this video, I encourage you to think differently about expenses and include one specific expense you may not have thought much about. Thank You Thank you for watching and I hope you have…

Read MoreThree Investment Lessons From 2022

Three Investment Lessons From 2022 Lesson #1 – Surprises Happen In 2022, we were surprised by the Russian invasion of Ukraine. We also experienced record high gas prices. In response to persistent inflation, the Fed increased interest rates significantly. This resulted in mortgage rates doubling and both stocks and bonds experienced double-digit losses for the…

Read MoreBoring is Beautiful

Boring is Beautiful Over the past few years, many investments have been hyped by the financial media and several have experienced near-parabolic gains. These include meme stocks, cryptocurrencies, major technology firms, and companies that thrived from changes during the pandemic. Hype and watching asset prices skyrocket produce a “get rich quick” mentality. This mentality activates…

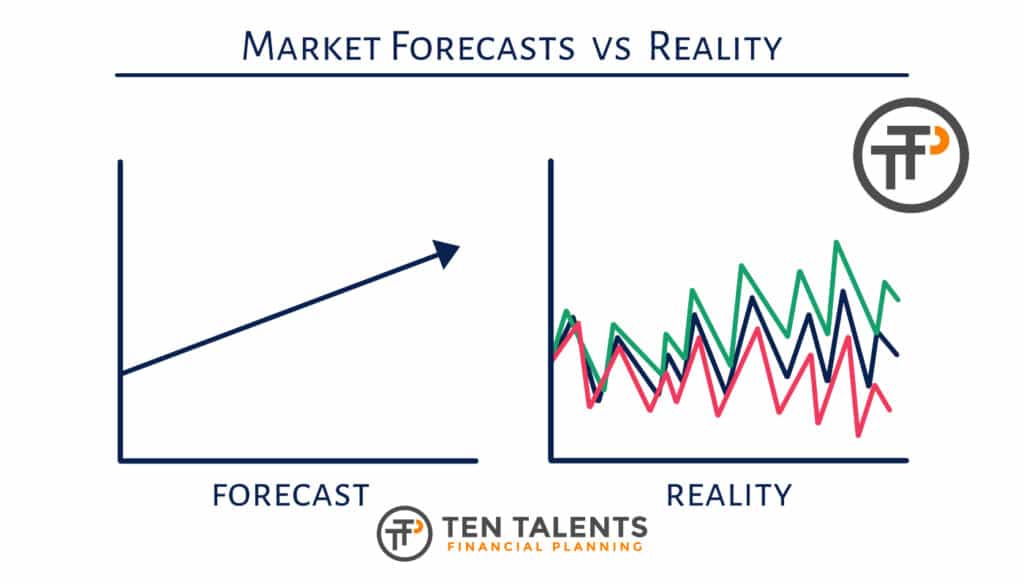

Read MoreTis the Season of Forecasts

Tis the Season of Forecasts It’s that time of year. No, not the holidays. It’s the time that every analyst, economist, and strategist will declare their forecasts for 2023. These forecasts come from well-educated, intelligent individuals – with many years of experience. Some of the forecasts will be made with much confidence. No matter. You…

Read MoreMyth Busting! (3 Common Financial Myths)

Myth Busting! (3 Common Financial Myths) Learn 3 common myths that I hear regularly as a financial planner. Roth Conversion Myth First myth relates to Roth conversions. 401(k) vs. IRA Myth Second myth relates to retiring early and keeping your 401(k) at your employer vs. moving to an IRA. IRA Penalty? Third myth relates to…

Read More