Roth IRA

Help! I Can’t Make Roth IRA Contributions Anymore

Help! I Can’t Make Roth IRA Contributions Anymore Have you noticed that you can’t make direct Roth IRA contributions once your income gets too high? Whether you are filing taxes as Single or Married Filing Jointly there are “Income Limits” for who can contribute to a Roth IRA. Roth 401(k) Has No Income Limits However,…

Read MoreHow can you (financially) bless your spouse?

How can you (financially) bless your spouse? Did you realize you can bless your spouse from a financial perspective, by doing tax planning in the here and now? While most people don’t like to think about leaving their spouse a widow or widower, it’s a reality that faces most couples. Widows/widowers taxes nearly double after…

Read MoreIgnoring the Noise (Market Predictions)

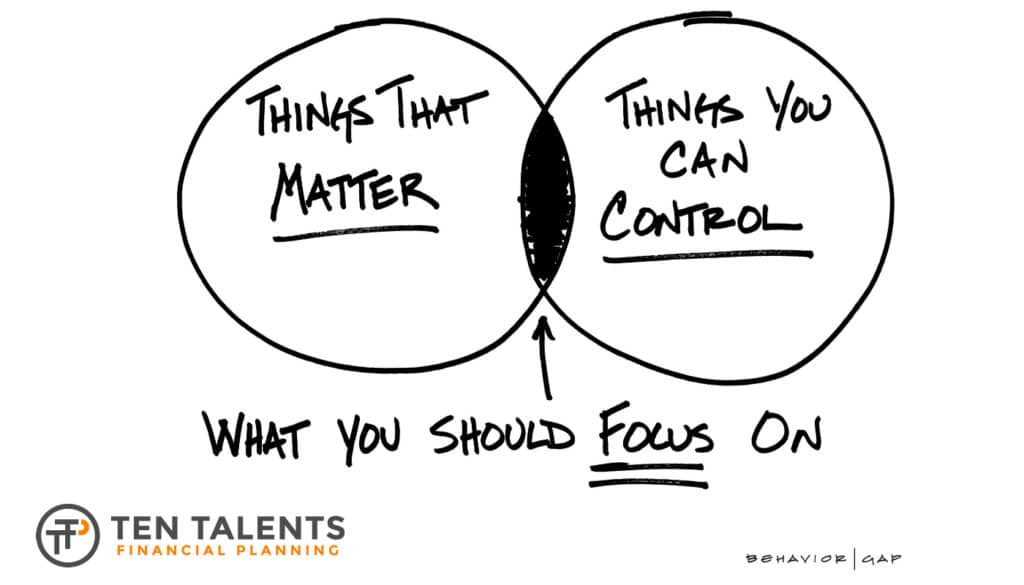

Ignoring the Noise (Market Predictions) Stock market predictions can be quite alluring. Especially those that are extreme and/or use fear-inducing images. Such predictions can influence our opinions and ultimately our decisions. For that reason, it is important that we protect ourselves from their subconscious, and potentially damaging, influence. Characteristics of Believable Market Predictions Predictions that are believable do…

Read MorePlanning for a Tax-Free Retirement (or how I learned to stop worrying and embrace Roth)

Inevitably, one of the topics brought up during a conversation with any financial planner is how to save money on taxes. Of course, if you have a significant tax “problem” you also have a very positive situation on your hands: A healthy six or seven-digit income (just trying to look on the bright side here!).…

Read MoreWhat’s On My Mind – Episode 104 – “You can save more in 2019!”

Welcome to the “What’s On My Mind” video series with Kaleb Paddock, a financial planner based in Parker, CO. It’s pretty straight-forward, click here to learn what’s on my mind. Thanks for watching! – Kaleb Paddock, CFP® You can learn more about Kaleb and Ten Talents here.

Read More