Blog Series

March Madness – Stock Market Edition

March Madness – Stock Market Edition As we prepare for basketball’s march madness tournament, it is a good time to reflect on how maddening the stock market can be. What causes the madness of the markets? Many things, but one of the greatest frustrations to investors is the significant fluctuations in asset prices, or volatility.…

Read MoreAre We Due for a Change?

Are We Due for a Change? In January the stock market, despite years of high interest rates and recession concerns, hit a new all-time high. This was largely driven by strong corporate earnings, a robust job market, and improving consumer sentiment. Whenever the market is on a long winning streak or even hits new highs,…

Read MoreSucceeding at Self-Control

Succeeding at Self-Control Self-control is an important characteristic to develop that can help us in all aspects of our lives from biting our tongue, to passing on the sweet treat, to accomplishing our New Year’s resolutions. But it isn’t easy! In fact, it can be downright painful, especially when trying to control some urge. It’s…

Read MoreWho Would Have Thought

Who Would Have Thought One of the best things about a year coming to an end is to look back and identify key lessons that we can use to improve our decision-making going forward. This is especially true in the investment realm. 2023 – Lots of Bad News Late in 2022, market and economic experts…

Read MoreTimely Economic Perspectives

Timely Economic Perspectives Recently the Wall Street Journal ran with a headline about “Quadruple Threats”1 to the economy. Not to be outdone, on the same day, Marketwatch.com posted an image highlighting five current threats to the economy. These threats are made to be, and can be, concerning. I break down the threats below to help…

Read MoreABC’s of Successful Investing

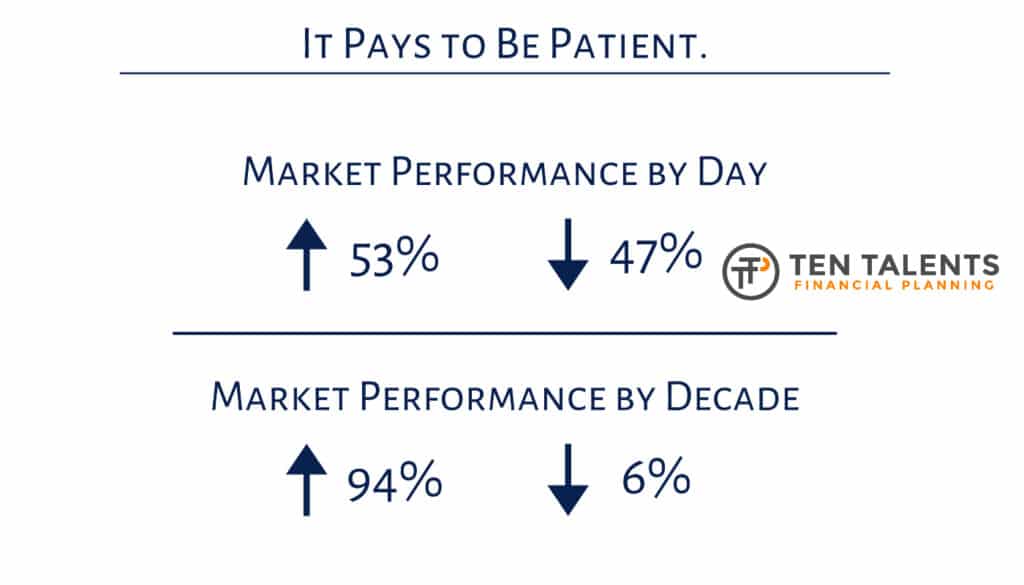

ABC’s of Successful Investing As the kids have gone back to school, it is a good time to review the ABCs of successful investing. A – Adjust Your Expectations Expect that stock market selloffs, which are normal, will occur quite regularly – it’s just the nature of beast. But historically the losses have been temporary.…

Read MoreThe Advantages of Low Expectations

The Advantages of Low Expectations We all want desirable outcomes – those outcomes that bring us happiness, peace, and prosperity. Because we desire such outcomes, we may go into situations having high expectations. But it may be more beneficial to temper our expectations if we want to experience greater contentment in life. Disappointment & Contentment…

Read MoreThe Eventual Recession

The Eventual Recession Since early last year economists, market experts, and even corporate CEOs were predicting a recession for this year. Most of them said it would happen early in the year.1 A recession was the consensus view among experts, almost a foregone conclusion. With inflation surging to 9% last summer and the Fed aggressively…

Read MoreDanger: Headlines Ahead

Danger: Headlines Ahead Mark Twain said, “Never let the truth get in the way of a good story.” It might be more applicable today if he said, “Never let the truth get in the way of a good headline.” Headline Characteristics The purpose of headlines is just to get you to click or tune in.…

Read MoreActing Like an Investor

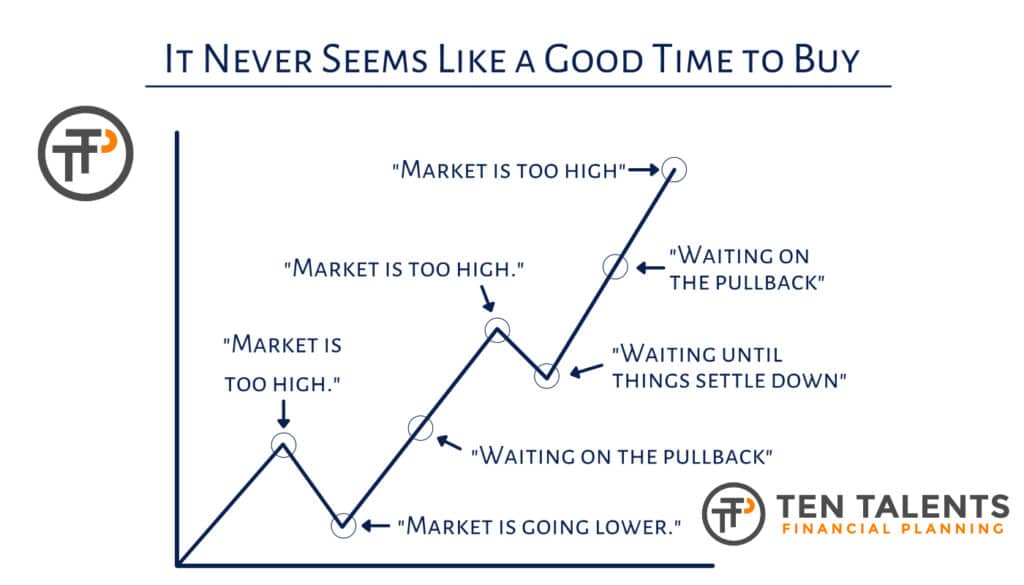

Acting Like an Investor Many investors today unknowingly act like speculators. How do I know this? Because they are more concerned and influenced by short-term stochastic changes in stock prices than in the underlying fundamentals of a company. And when coupled with a barrage of negative news stories, it can be very difficult to act…

Read More