Are We Due for a Change?

Are We Due for a Change?

In January the stock market, despite years of high interest rates and recession concerns, hit a new all-time high. This was largely driven by strong corporate earnings, a robust job market, and improving consumer sentiment.

Whenever the market is on a long winning streak or even hits new highs, it may be tempting to consider whether you should lock in your gains. After all, no one wants to see their gains evaporate.

But before making any investment decision, it is important consider all perspectives.

The “What If” Perspective

For example, if you were to lock in your gains, what would you do with the money? Where would you put it and for how long? How would you know when it’s time to get back into the market?

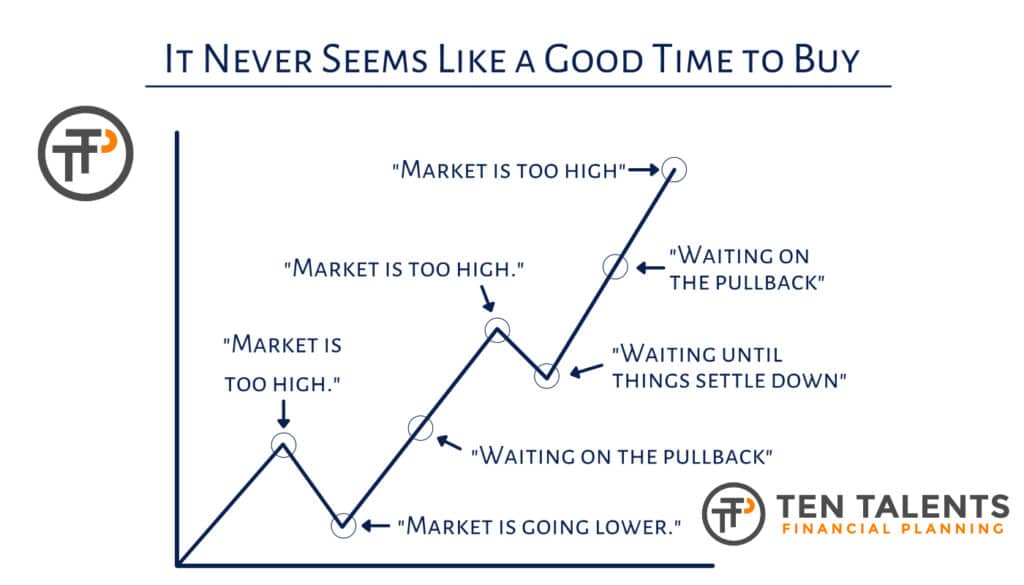

While we may think locking in gains is a form of protection, it is really a form of market timing.

And market timing can be a very costly and stressful endeavor.

The Historical Perspective

According to Truist, the market has historically performed very well after making new record highs.

Since 1954, they found that the market was higher one year after making a new record high after at least a year 93% of the time.1

And JP Morgan found that investing on days when the market hits all-time highs has historically yielded better returns than investing on any other day of the year.2

In other words, history does not offer any evidence that a market hitting all-time highs means the market is due to go down.

If anything, the evidence demonstrates that new market highs often result in higher highs.

Final Thoughts

It’s important to know that the feeling to protect money is completely natural, but after considering other perspectives you may realize that may not be a wise decision.

As I always say, practicing discipline to your plan is often the best course of action.

Stay invested,

– Kaleb Paddock, CFP®

Learn More

You can learn more about Ten Talents and Kaleb Paddock, a financial advisor based in Parker, Colorado, by clicking here.

Kaleb can be reached at (720) 710-0939 or kaleb@tentalentsfp.com.

You can check out the Ten Talents YouTube channel by clicking here.

- Source: Truist, Market Perspective, Jan 19, 2024

- Source: JP Morgan, Is it Worth Investing at All Time Highs, Aug 28, 2020

© The Behavioral Finance Network.

Planning ahead for retirement?

Get the 7 Essentials for Successful Investing in Retirement.