Why ‘average returns’ DO NOT matter in retirement!

Do you have retirement on your mind? Have you already retired in the last year or two? Average return is misleading As you think about your retirement and investment portfolio, it’s common to focus on achieving an “average return” and think that’s your ticket to not outliving your retirement savings. But do you understand that…

Read More Cost of Investor Behavior

Investors often respond emotionally to the market. And whether that emotion is fear of loss or fear of missing out, it is powerful. We are inclined to sell something that goes down and buy whatever is doing well. This has been going on for decades and continues to this day. It’s just about as reliable…

Read More A Persistent Forecast for 2021

Persistent (def) – continuing to exist or endure over a prolonged period Wall Street forecasts lack persistence. Their shelf life may only be a few weeks or months at best. 2020 was a great example; once COVID hit, existing forecasts became worthless. And this happens just about every year – excuses abound as to why…

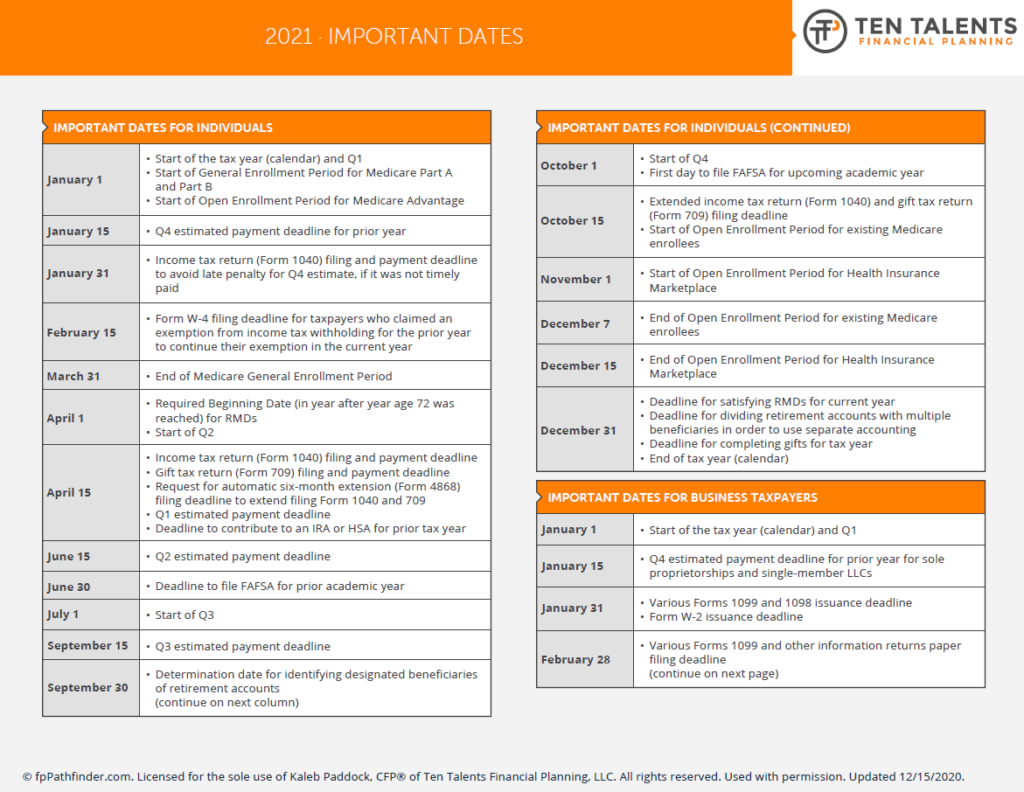

Read More Important Dates in 2021 (Infographic)

Are you looking forward to 2021? Here are some important financial planning checklist dates to keep in mind! Please click the graphics below to check them out. Please let me know if you would like a PDF copy of these dates and I’m happy to send that to you (and NOT sign you up for…

Read More Featured Non-Profit – “SECORCares” in Parker, CO

Poverty lives here? Poverty. The term conjures up certain images in our minds. A home in disrepair; a child in tattered clothing, a person begging for money on the side of the street. We think of third world poverty, rural poverty or urban poverty. Most people, however, don’t expect to find poverty in suburbia. Loss of…

Read More Prospective Hindsight

The next twelve months may be an especially interesting time. There is hope, but there is still much unknown. Let’s mind travel to December 2021. Next year at this time, we may look back and say, “Of course, how did I miss that”? This activity of jumping forward to look back is known as prospective…

Read More What to do with that old 401(k) account?

More likely than not, you’ve changed jobs at least a couple times in your career. When you change companies, it isn’t unusual to leave behind or forget your retirement account (401(k), 403(b), 457, TSP). Often, these old accounts are neglected or rarely revisited for many years. But tending to them is important. Your original investment…

Read More Investment returns and why dividends matter (and they matter a lot)

On January 22, 2018 the S&P 500 Index closed with a price of 2872.87. On April 1, 2019 the S&P 500 Index closed with a price of 2866.29. In other words, over nearly 15 months the S&P 500 Index lost 6.58 points, or -0.23%. All the headlines. The noise. The up days and down days.…

Read More Intentional Gratitude

‘Tis the season of gratitude. Thanksgiving is perhaps one of the most underappreciated holidays, but most needed. Given the year we have endured it may be difficult to be naturally thankful. This year may require us to purposefully and intentionally seek to be grateful. Gratitude Attitude There are so many things beyond our individual control…

Read More What is a fiduciary (and why should you care)?

When was the last time you visited the doctor? Perhaps it was an annual check-up or physical. Whenever that last visit was, you likely were not wondering whether your physician had your best interests at heart when you asked questions about your health. Unfortunately, the same can’t always be said when you visit a fiscal…

Read More Planning ahead for retirement?

Get the 7 Essentials for Successful Investing in Retirement.