Blog Series

If Money Doesn’t Buy Happiness, What Does?

If Money Doesn’t Buy Happiness, What Does? For centuries mankind has been searching for happiness. Regardless of culture, social status, or beliefs it seems that we are all connected by our desire to be happy. What makes someone happy and how much happiness we feel may be subjective. But there are a few fundamental principles that…

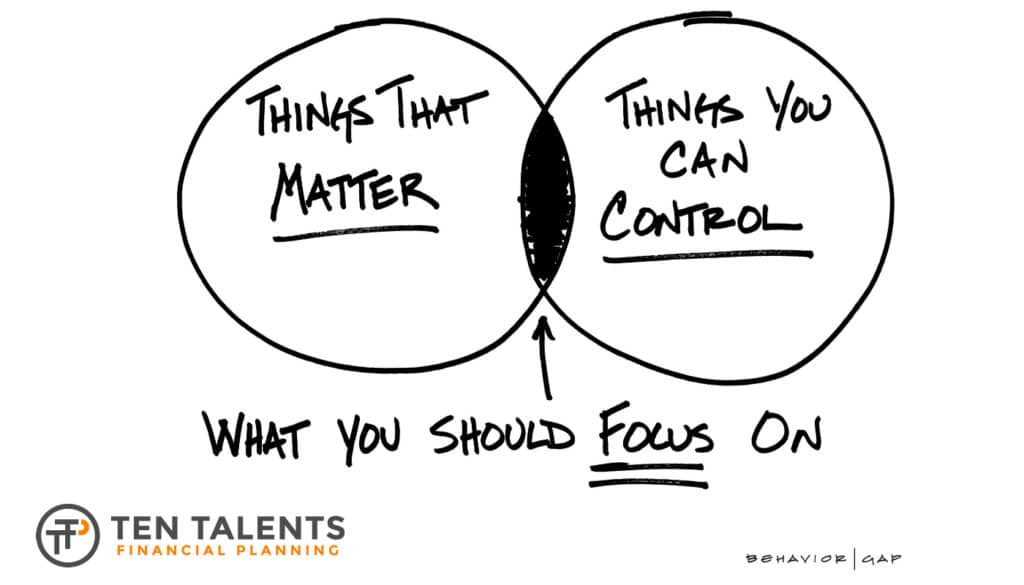

Read MoreAttention Allocation

Attention Allocation You may be familiar with the term “asset allocation”, which is how we divide up our assets (stocks, bonds, cash etc.). Attention allocation is how we divide up our attention. Paradox of Abundance The paradox of abundance states that there is a tradeoff between quantity and quality. The greater the quantity of a…

Read MoreTrusting Your Investment Decisions

Trusting Your Investment Decisions Sometimes investing is easy, sometimes it is more difficult. The last decade, except for a handful of temporary declines, has been relatively easy. It consisted of very low interest rates, low inflation, and lots of fiscal and monetary stimulus. And stock markets were quite positive. Since 2009, the S&P 500 annualized…

Read MoreSurviving Volatility

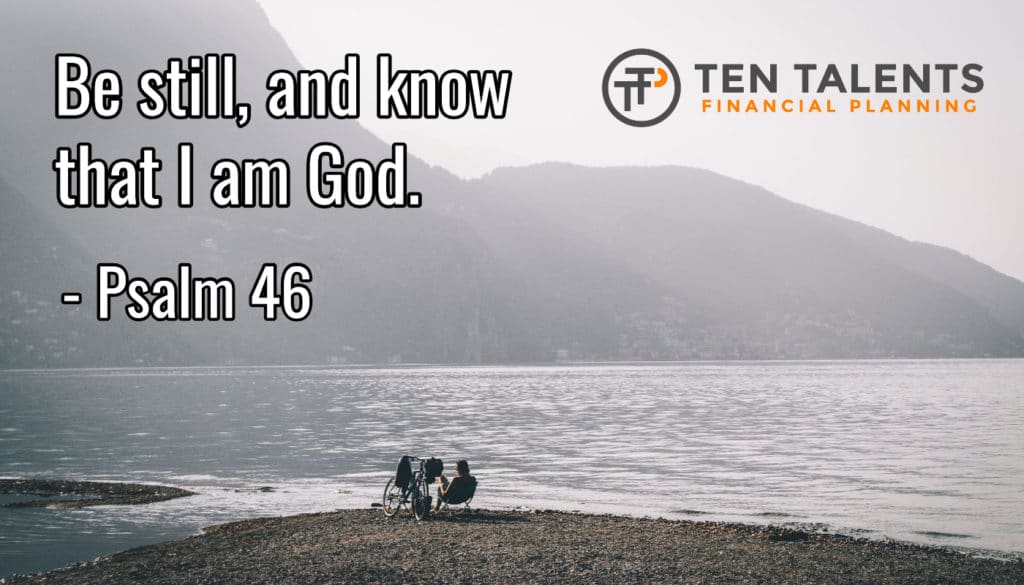

Surviving Volatility When volatility increases, many investors become uncomfortable and may consider making changes to their investments. Anytime we have a significant concern, it is essential we take a step back and assess the situation with the proper perspective. Normal, Not Easy Volatility, while uncomfortable, is a normal and natural part of stock markets. It…

Read MoreThe Power of Remembering

The Power of Remembering Memorial Day is a time of remembering, reflecting, and honoring those who gave the ultimate sacrifice for the freedoms we enjoy today. The act of remembering often brings feelings of gratitude, love, and a desire to do good to others. It is positive and empowering. While remembering can be very powerful…

Read MoreCrises in Context

Crises in Context One thing investors can count on is that they will hear numerous reports economic and market crises throughout their investment experience. Some of these will be actual crises; the majority will be nothing more than noise. Crisis du Jour The crisis du jour, as spewed by the financial media, pertains to predictions…

Read MoreThoughts on Thinking

Thoughts on Thinking The ability to think clearly and draw correct conclusions is necessary in everyday life, especially when it comes to making important decisions. But thinking critically is not natural; it’s not the way our brains are hardwired. Instead, we are hardwired to follow the path of least resistance, which often results in hasty…

Read MoreIgnoring the Noise (Market Predictions)

Ignoring the Noise (Market Predictions) Stock market predictions can be quite alluring. Especially those that are extreme and/or use fear-inducing images. Such predictions can influence our opinions and ultimately our decisions. For that reason, it is important that we protect ourselves from their subconscious, and potentially damaging, influence. Characteristics of Believable Market Predictions Predictions that are believable do…

Read MoreInvesting Amid Uncertainty

Investing Amid Uncertainty Many investors express discomfort when things are uncertain. This is especially true when experiencing “heightened uncertainty,” such as with the current Eastern European conflict. However, uncertainty is not just a fact of economic and investment markets, it is a fact of life. Our future, by definition, is uncertain. There are times when…

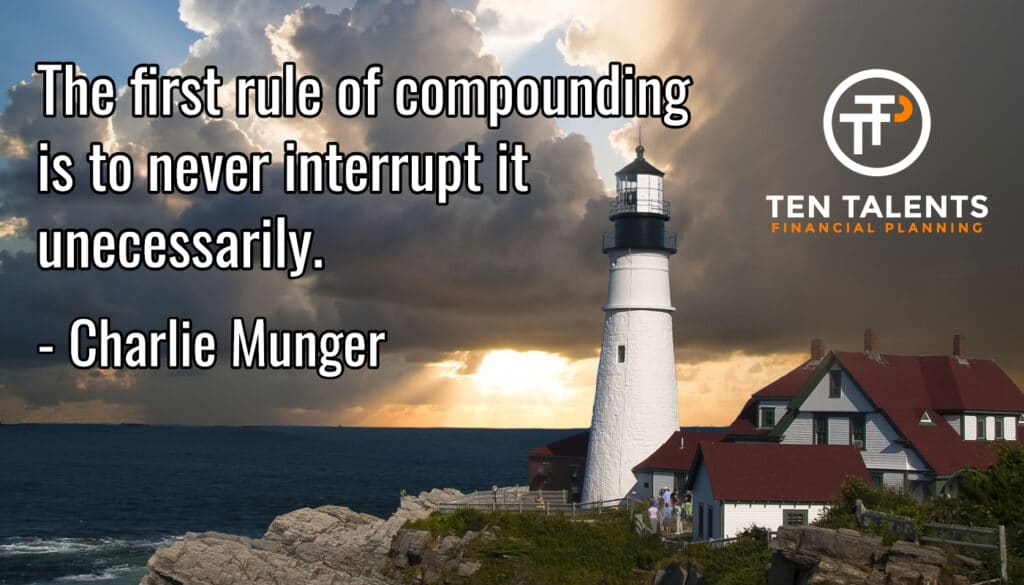

Read MoreThe Challenge of Selling

The Challenge of Selling Selling an investment is something that investors ponder from time to time. The challenge of selling, whether that investment is an individual stock, a mutual fund, or an index fund, is that investors are left with the question of what to do with the proceeds? No matter the reason for selling,…

Read More