Financial Planning

Oh snap! Your ‘advisor’ doesn’t do retirement planning after all.

Oh snap! Your ‘advisor’ doesn’t do retirement planning after all. It’s an unsettling feeling to learn your Financial “Advisor” doesn’t do retirement planning. What does that mean? Have you ever wondered about the following topics? -When to claim Social Security benefits? -How does healthcare work before Medicare at age 65? How does it work after…

Read MoreWhen Less Can Give You More

When Less Can Give You More We are generally in the pursuit of more. More income, more recognition, more opportunities, more happiness etc.… Because “more” often results in desirable outcomes, it is natural to think in terms of what we can get or do more of, rather than what we can do less of. But…

Read MoreWhat Game Are You Playing?

What Game Are You Playing? How do you think you would do playing tennis and using a golf club, instead of a racket? Or driving down the basketball court wearing hockey skates? Using the wrong equipment for the game we are playing will negatively affect our performance. The same thing can be said for investing.…

Read MoreResolutions and Habits

Resolutions and Habits As New Year’s Day is now in the rear-view mirror, we can surmise that people are struggling to keep their resolutions. Indeed some may have already given up, perhaps with a determination that next year will be the year. A long-term study by the University of Scranton found that less than 10%…

Read MoreHave You Considered this HUGE Expense in Retirement?

Have You Considered this HUGE Expense in Retirement? Have you ever considered your largest expenses during your retirement years? Think Differently In this video, I encourage you to think differently about expenses and include one specific expense you may not have thought much about. Thank You Thank you for watching and I hope you have…

Read MoreThree Investment Lessons From 2022

Three Investment Lessons From 2022 Lesson #1 – Surprises Happen In 2022, we were surprised by the Russian invasion of Ukraine. We also experienced record high gas prices. In response to persistent inflation, the Fed increased interest rates significantly. This resulted in mortgage rates doubling and both stocks and bonds experienced double-digit losses for the…

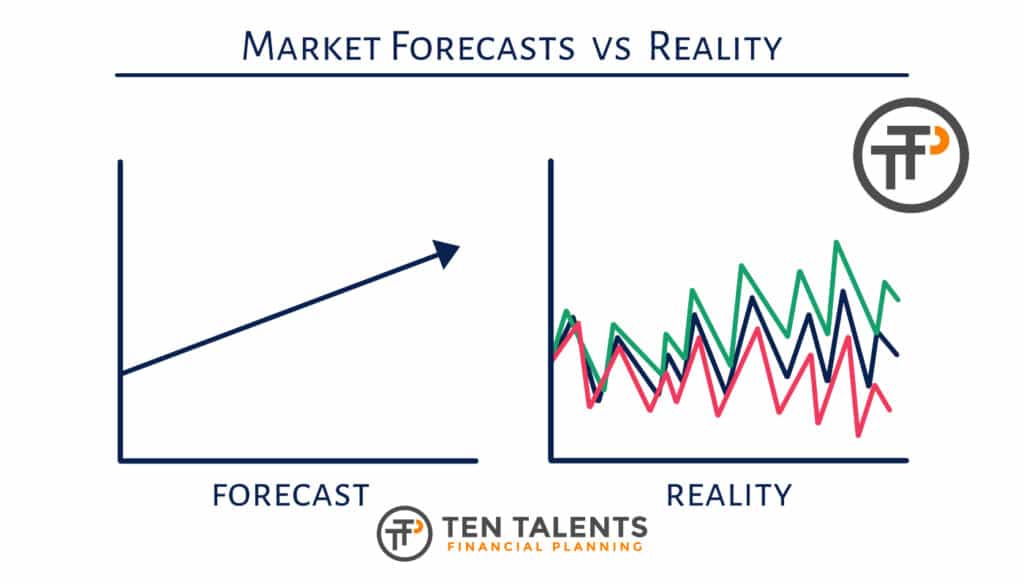

Read MoreThe Only Forecast That Matters

The Only Forecast That Matters Most investors love economic and market forecasts. With the markets so uncertain and volatile, our brain craves some sort of idea of what the future holds. But the markets are unpredictable – evidenced by the fact that no one can consistently predict them with accuracy. Of course, a certain forecast…

Read MoreBoring is Beautiful

Boring is Beautiful Over the past few years, many investments have been hyped by the financial media and several have experienced near-parabolic gains. These include meme stocks, cryptocurrencies, major technology firms, and companies that thrived from changes during the pandemic. Hype and watching asset prices skyrocket produce a “get rich quick” mentality. This mentality activates…

Read MoreStop Giving Cash to Charity

Stop Giving Cash to Charity Are you already giving monthly or annually to your favorite 501(c)(3) charities? Do you own a brokerage account that has unrealized capital gains from stocks, mutual funds, or ETFs? You may want to stop giving cash to charity. Benefits of a Donor Advised Fund (DAF) Consider stopping your cash giving…

Read MoreTis the Season of Forecasts

Tis the Season of Forecasts It’s that time of year. No, not the holidays. It’s the time that every analyst, economist, and strategist will declare their forecasts for 2023. These forecasts come from well-educated, intelligent individuals – with many years of experience. Some of the forecasts will be made with much confidence. No matter. You…

Read More