Tis the Season of Forecasts

Tis the Season of Forecasts

It’s that time of year. No, not the holidays. It’s the time that every analyst, economist, and strategist will declare their forecasts for 2023.

These forecasts come from well-educated, intelligent individuals – with many years of experience. Some of the forecasts will be made with much confidence.

No matter. You shouldn’t heed them.

Folly of Forecasts

Historically, the accuracy of financial expert predictions is less than 50%.1 Why is that?

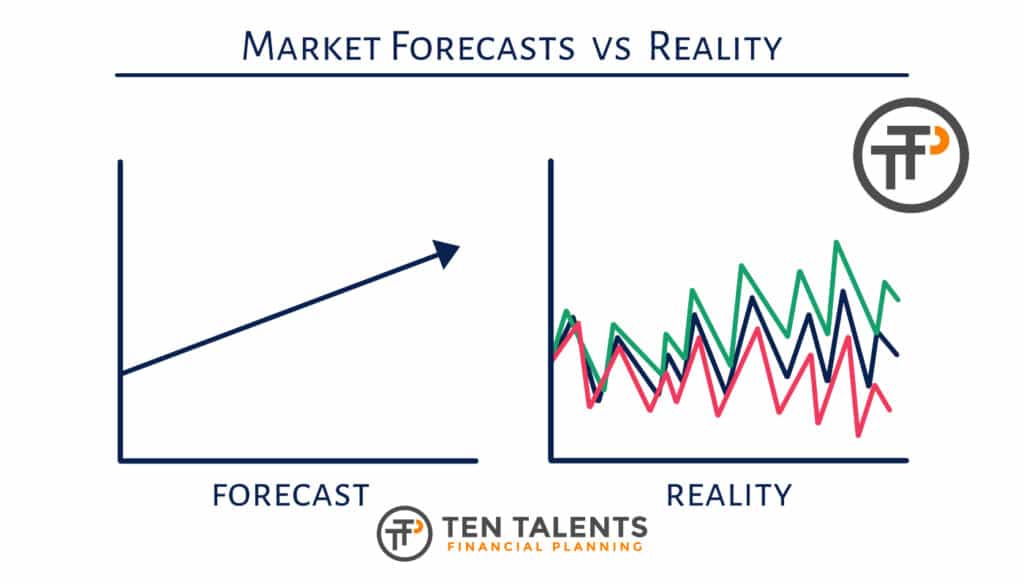

It’s not that the experts aren’t intelligent or have bad information. It’s because the markets and economies are unpredictable. They always have been. The proof lies in the fact that no one has ever been able to consistently predict future market or economic outcomes.

Last month two highly experienced, well-known, and respected economists provided forecasts along with compelling evidence and arguments to support their forecast. Want to know what they said? The complete opposite of each other!

One predicted market fragility and more frequent and violent economic shocks.2 The other said the inflation surge is over and expects the market to rally in December and continue into next year.3 Contradictory financial forecasts are commonplace because no one knows exactly how things will play out, despite relying on the same information.

Appeasing Uncertainty

Even when we understand that markets are unpredictable, we still want to read what the experts have to say.

This is because our brain, while consisting of a lot of gray matter, hates gray areas. Not knowing can sometimes be worse than receiving bad news because the brain doesn’t know what decision to make today for a better future tomorrow.

Uncertainty is an inherent element of the markets. Rather than pretend some financial guru knows what will happen, it is best to understand the limits of our knowledge – and that of others.

Where Should We Focus Instead?

We should spend our time and attention on those things that are knowable (investment truths) and investment situations we control.

Having a durable investment strategy is essential. When we have a good plan we don’t need to worry about what will happen in the short term. We can allow our plan to guide our thoughts, perceptions, and actions.

Do we invest based on the market movement, headline, or prediction of the day? Or do we invest according to a plan that follows enduring investment principles and is customized to our personal situation? I recommend the latter.

Stay invested,

– Kaleb Paddock, CFP®

Learn More

You can learn more about Ten Talents and Kaleb Paddock, a financial advisor based in Parker, Colorado, by clicking here.

Kaleb can be reached at (720) 710-0939 or kaleb@tentalentsfp.com.

You can check out the Ten Talents YouTube channel by clicking here.

About Kaleb

Hi, I’m Kaleb. and I’m the Founder of Ten Talents. I’m blessed to be regularly featured in CNBC, MONEY, and Business Insider personal finance articles. I’m a CERTIFIED FINANCIAL PLANNER™ (CFP®) Professional based in Parker, Colorado and I’m a fiduciary and fee-only advisor.

Put simply, this means that I don’t sell you financial products. I act in your best interest at all times. And my pricing is clear and easy to understand.

My Client are Eyeing Retirement Decisions

My clients are eyeing retirement decisions, often work at technology companies, or have experienced a sudden money event (inheritance, home sale, business sale, stock IPO, gift).

I love bringing confidence and clarity to your financial situation and I’m passionate about helping you take control of your financial future.

You can learn more about me and Ten Talents by visiting my website: www.tentalentsfp.com.

©2022 The Behavioral Finance Network.

- CXO Advisory. Guru Grades

- https://markets.businessinsider.com/news/currencies/top-economist-mohamed-el-erian-recession-global-economy-federal-reserve-2022-11

- https://www.cnbc.com/2022/11/21/stocks-could-rally-as-much-as-20percent-in-2023-whartons-jeremy-siegel-says.html

Planning ahead for retirement?

Get the 7 Essentials for Successful Investing in Retirement.