Taxes

Have You Considered this HUGE Expense in Retirement?

Have You Considered this HUGE Expense in Retirement? Have you ever considered your largest expenses during your retirement years? Think Differently In this video, I encourage you to think differently about expenses and include one specific expense you may not have thought much about. Thank You Thank you for watching and I hope you have…

Read MoreHow can you (financially) bless your spouse?

How can you (financially) bless your spouse? Did you realize you can bless your spouse from a financial perspective, by doing tax planning in the here and now? While most people don’t like to think about leaving their spouse a widow or widower, it’s a reality that faces most couples. Widows/widowers taxes nearly double after…

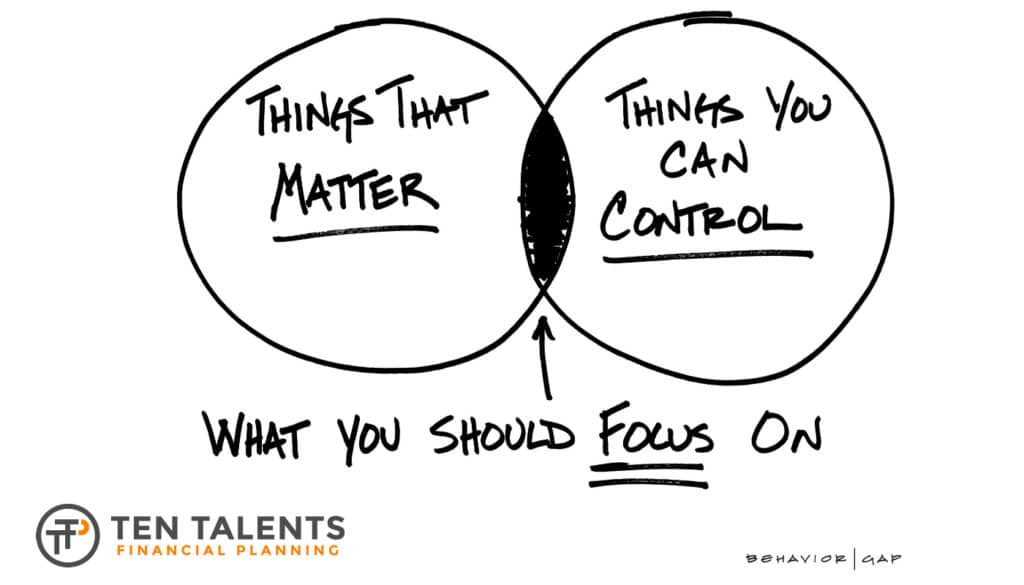

Read MoreIgnoring the Noise (Market Predictions)

Ignoring the Noise (Market Predictions) Stock market predictions can be quite alluring. Especially those that are extreme and/or use fear-inducing images. Such predictions can influence our opinions and ultimately our decisions. For that reason, it is important that we protect ourselves from their subconscious, and potentially damaging, influence. Characteristics of Believable Market Predictions Predictions that are believable do…

Read More$9,000 of Tax Savings!

Learn Why I Ask For Your Tax Return (tax savings opportunities!) Learn why I ask for your last 2 years of tax returns when you become a Ten Talents client! (Hint: There are tax savings opportunities hanging out in that return.) Recently, through amending the last 2 years of tax returns, a Ten Talents client…

Read MoreColorado’s state income tax laws are changing!

Colorado’s state income tax laws are changing! On June 23, 2021, Governor Jared Polis signed HB21-1311 which will be changing Colorado’s state income tax laws. Are you aware of the changes that affect you? Will these changes affect you? Did you know this bill changes tax rules for things like College 529 account contributions? Did…

Read MoreDid you know there’s a 0% tax bracket?

Did you know there’s a 0% tax bracket? You can pay 0% tax rate below certain income thresholds on your long-term capital gains. And you can take advantage of this 0% tax bracket by carefully reviewing your tax planning each year! But these would be gains taken in a brokerage account, NOT a retirement account.…

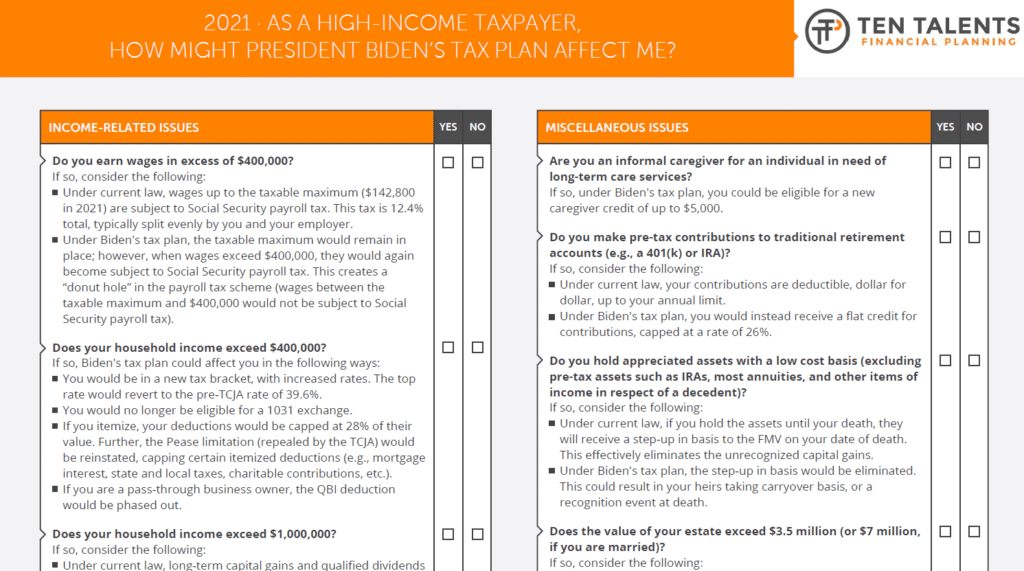

Read MoreHelpful Checklist – Biden Tax Plan!

Are you like me? Does it drive you nuts when companies force you to hand over your email address to obtain a helpful piece of content? Yep, I felt we were kindred spirits on this one. The helpful piece of content in this post is a checklist of issues to consider if you are earning…

Read MoreThe Retirement Account Hiding in Plain Sight

UPDATED 05/18/2023 The Retirement Account Hiding in Plain Sight If you’ve been saving towards retirement for any length of time, chances are you’ve heard about IRAs, Roth IRAs, 401(k)s, 403(b)s, and 007(e)(i)(e)(i)(o)s (okay, that last one wasn’t real). All these accounts are great, and you should be using them as best fits your circumstance. But…

Read MoreWhat’s On My Mind – Episode 155 – “Colorado Homeowner’s Tax Exemption!”

Do you know about the Colorado homeowner’s tax exemption and other tax benefits to retirees? You may qualify for a property tax reduction if you own your home and you are retired in Colorado! Learn more about the Colorado homeowner’s tax exemption for retirees by watching below or click here to watch on YouTube. Also,…

Read MorePlanning for a Tax-Free Retirement (or how I learned to stop worrying and embrace Roth)

Inevitably, one of the topics brought up during a conversation with any financial planner is how to save money on taxes. Of course, if you have a significant tax “problem” you also have a very positive situation on your hands: A healthy six or seven-digit income (just trying to look on the bright side here!).…

Read More