Investment management

Investing Amid Uncertainty

Investing Amid Uncertainty Many investors express discomfort when things are uncertain. This is especially true when experiencing “heightened uncertainty,” such as with the current Eastern European conflict. However, uncertainty is not just a fact of economic and investment markets, it is a fact of life. Our future, by definition, is uncertain. There are times when…

Read MoreWhat would happen if you were blindsided?

What would happen if you were blindsided? What would happen if you were blindsided in your car as you drive home from work tonight? Not an accident leading to your death, but you simply are injured, can’t work, and your spouse is left having to piece together accessing accounts and contacting key people? The value…

Read MoreThe Challenge of Selling

The Challenge of Selling Selling an investment is something that investors ponder from time to time. The challenge of selling, whether that investment is an individual stock, a mutual fund, or an index fund, is that investors are left with the question of what to do with the proceeds? No matter the reason for selling,…

Read MoreMarket Declines

Market Declines Market declines can cause great angst, uncertainty, and fear. During these times, maintaining proper perspective is essential to making good investment decisions. Three Perspectives on Market Declines Three perspectives I have found helpful are: Be prepared for negative news. There has already been talk of a bubble bursting and headlines promoting the “worst…

Read MoreThe Problem with Stock Picking

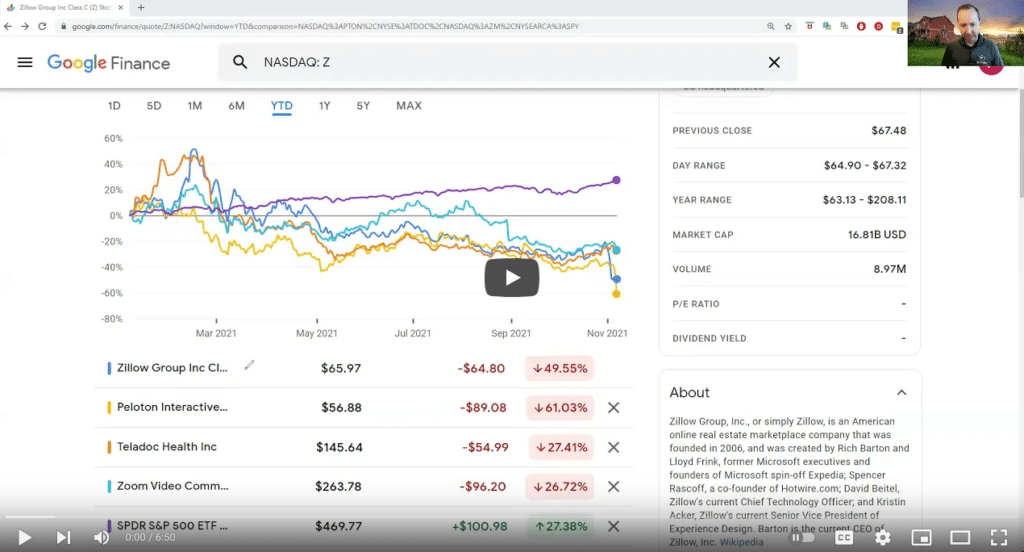

The Problem with Stock Picking Did you start day trading in 2020? And did you get caught up in stock picking like millions of Americans? Maybe you downloaded Robinhood and started buying Zillow, TeleDoc, Peloton, or Zoom with your stimulus checks? What happened to these high flying pandemic stocks? And now that we have passed…

Read MoreMarket Contagions

Market Contagions It is the time of year when we are constantly reminded to beware of viruses. This year we have the return of the flu plus COVID in many parts of the country. But we shouldn’t forget about the contagion that knows no season, that of stock market contagions. Power of Sensationalism Forecasts, stock…

Read MoreAre you afraid of the stock market crashing?

Are you afraid of the stock market crashing? Have you been watching way too much financial pornography? Are you fearful of global destruction and complete collapse of the financial system? You need a financial thinking partner! Learn why we build beautifully diversified portfolios and why having a financial thinking partner can save you from the…

Read MoreSherpa or no Sherpa? Guide or no guide?

Sherpa or no Sherpa? Guide or no guide? How do you like to climb mountains? Are you a DIY climber or do you choose to hire an experienced guide? Go alone, or hire a guide? Which option is better, to go it alone, or to hire a guide? Your answer to this question will help…

Read MoreThe Volatility Tax

The Volatility Tax (or why being beautifully diversified matters!) Have you heard the phrase, “more risk, always means more reward!”? Do you think that if you are down 50 percent in an investment or account, that you need a 50 percent gain to breakeven? Learn about the volatility tax by watching the video below Learn…

Read MoreLearning From Investment Fads

As we are midway through the year, it can be a good idea to take stock of what happened so far, and what we can learn from the investment fads so far this year. Looking back is an important activity as we seek to progress. It’s not about beating ourselves up for mistakes or feeding our…

Read More