The Magnificence of Diversification

The Magnificence of Diversification Diversification is often defined as “Don’t put all your eggs in one basket.” It’s something we do to reduce volatility and manage risk. But there is another reason to diversify. We diversify in an attempt to increase the return on our investments. Diversification provides opportunity for investors to both reduce risk…

Read More Bank Failures Are More Common Than You Think

Bank Failures Are More Common Than You Think Check out this link to learn more about the almost 600 bank failures in the past 23 years! Bank failures are more common than you think and you can use this link below to review on your own. Check Out This FDIC Link You can learn more…

Read More The Virtue of Slowing Down

The Virtue of Slowing Down Time is an interesting dimension. It is a fixed measurement, yet our perception of time varies greatly depending on what we are doing. It has been said that the longest eight seconds in life is riding a bull. I never rode a bull and have no interest in testing that…

Read More How to Make Money In Stocks

How to Make Money In Stocks This is how you make money in stocks! Hint: It actually starts with cash. 🙂 Cash is the Key Learn how holding cash enables you to make higher stock market returns over time. Thank You Thank you for watching and I hope you have a blessed day! – Kaleb…

Read More The Advantages of Low Expectations

The Advantages of Low Expectations We all want desirable outcomes – those outcomes that bring us happiness, peace, and prosperity. Because we desire such outcomes, we may go into situations having high expectations. But it may be more beneficial to temper our expectations if we want to experience greater contentment in life. Disappointment & Contentment…

Read More Remember This During Market Declines

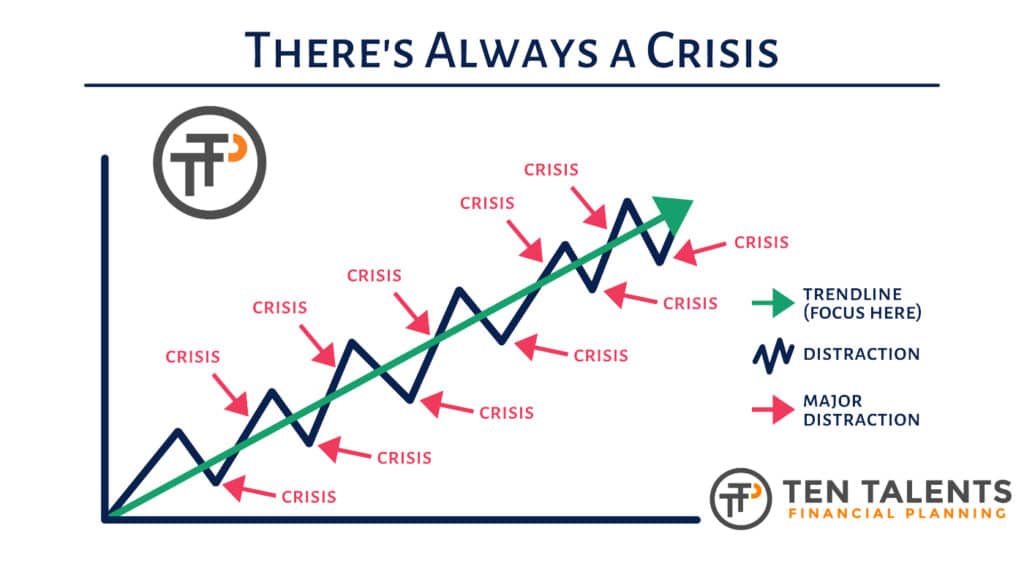

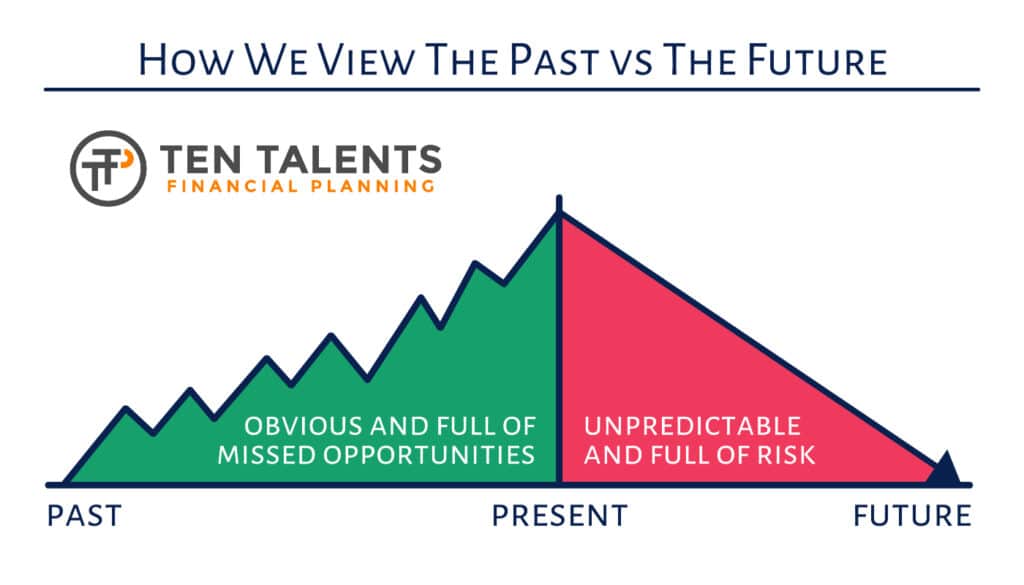

Remember This During Market Declines Are you thinking it’s time to take excess risk since your investments are declining or sideways? We’d say, “Remember This During Market Declines” to help frame correct perspective. Impatient or antsy? Are you getting impatient and antsy with your investments? Focusing on truth Instead, realize the TRUTH of what really…

Read More What if You Got a Glimpse of the Market’s Future?

What if You Got a Glimpse of the Market’s Future? Let’s say your friend came back from the future and shared a glimpse of stock market performance. He said that 3 months from now the stock market will be lower. He didn’t elaborate but hearing that the market would be lower got you concerned. You…

Read More How much life insurance do I need?

How much life insurance do I need? Have you ever wondered about how much life insurance is enough life insurance? Rules of Thumb Won’t Cut It Have you come across “rules of thumb” online like getting 10x your annual income? Keep Finance Personal Learn why the amount of life insurance you should own is an…

Read More Investment Counsel from Warren Buffett

Investment Counsel from Warren Buffett Investing may be simple in principle, but it isn’t easy in practice. Markets and economies are fraught with uncertainty, constantly changing news and markets, and how great some other investment is performing. Warren Buffett is one of the most successful investors of all time. From time to time he shares…

Read More Investing When News Is Horrible

Investing When News Is Horrible Have you turned on the news lately? Do you feel like bad news is getting so bad you CANNOT possibly invest when bad things are happening in the world? How Can You Invest Well? In this video, we ask if there has ever been a time in the history of…

Read More Planning ahead for retirement?

Get the 7 Essentials for Successful Investing in Retirement.