Have You Considered this HUGE Expense in Retirement?

Have You Considered this HUGE Expense in Retirement? Have you ever considered your largest expenses during your retirement years? Think Differently In this video, I encourage you to think differently about expenses and include one specific expense you may not have thought much about. Thank You Thank you for watching and I hope you have…

Read More Three Investment Lessons From 2022

Three Investment Lessons From 2022 Lesson #1 – Surprises Happen In 2022, we were surprised by the Russian invasion of Ukraine. We also experienced record high gas prices. In response to persistent inflation, the Fed increased interest rates significantly. This resulted in mortgage rates doubling and both stocks and bonds experienced double-digit losses for the…

Read More The Only Forecast That Matters

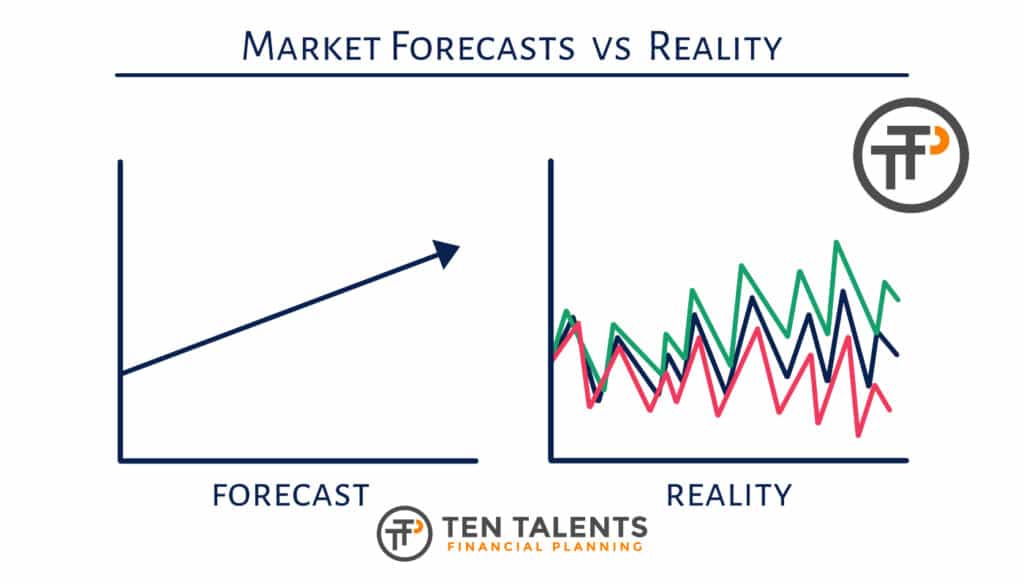

The Only Forecast That Matters Most investors love economic and market forecasts. With the markets so uncertain and volatile, our brain craves some sort of idea of what the future holds. But the markets are unpredictable – evidenced by the fact that no one can consistently predict them with accuracy. Of course, a certain forecast…

Read More Boring is Beautiful

Boring is Beautiful Over the past few years, many investments have been hyped by the financial media and several have experienced near-parabolic gains. These include meme stocks, cryptocurrencies, major technology firms, and companies that thrived from changes during the pandemic. Hype and watching asset prices skyrocket produce a “get rich quick” mentality. This mentality activates…

Read More Stop Giving Cash to Charity

Stop Giving Cash to Charity Are you already giving monthly or annually to your favorite 501(c)(3) charities? Do you own a brokerage account that has unrealized capital gains from stocks, mutual funds, or ETFs? You may want to stop giving cash to charity. Benefits of a Donor Advised Fund (DAF) Consider stopping your cash giving…

Read More Tis the Season of Forecasts

Tis the Season of Forecasts It’s that time of year. No, not the holidays. It’s the time that every analyst, economist, and strategist will declare their forecasts for 2023. These forecasts come from well-educated, intelligent individuals – with many years of experience. Some of the forecasts will be made with much confidence. No matter. You…

Read More Myth Busting! (3 Common Financial Myths)

Myth Busting! (3 Common Financial Myths) Learn 3 common myths that I hear regularly as a financial planner. Roth Conversion Myth First myth relates to Roth conversions. 401(k) vs. IRA Myth Second myth relates to retiring early and keeping your 401(k) at your employer vs. moving to an IRA. IRA Penalty? Third myth relates to…

Read More Cash: Benefits & Dangers

Cash: Benefits & Dangers When stocks and bonds experience negative performance, as they have this year, many investors become interested in cash. Indeed, some will repeat the mantra, “cash is king.” This has certainly been the case this year as nominal yields have been increasing to levels we haven’t seen in years. But, as with…

Read More A Photo From July, 2020

A Photo From July, 2020 This is a photo from July, 2020 when my family and I were in the Denver Airport heading out on a flight. This is the security line. This Too Shall Pass I took a picture because I could “picture” (through prospective hindsight) that this would be an incredible moment that…

Read More You Can Do Anything, But Not Everything

You Can Do Anything, But Not Everything Learn how a financial planner helps you with trade-offs and prioritizing your most treasured values and dreams. The advisor does NOT enable an “everything” version of your life. Optimizing Your Values The advisor helps you optimize your values through your money decisions. Thank You Thank you for watching…

Read More Planning ahead for retirement?

Get the 7 Essentials for Successful Investing in Retirement.